Solar Systems - 0% VAT for Private Customers in Germany

We are pleased to inform you that, in line with the tax relief measures decided upon by the German Federal Government in the draft of the Annual Tax Act (JstG 2022), Frenchman Energy can now supply solar systems and components to private customers in Germany without charging VAT. This benefit applies both to the sale of generated electricity, which is subject to income tax, as well as to the VAT for the purchase, delivery, and installation of photovoltaic systems and energy storage devices.

How to Order VAT-Free in Our Online Shop:

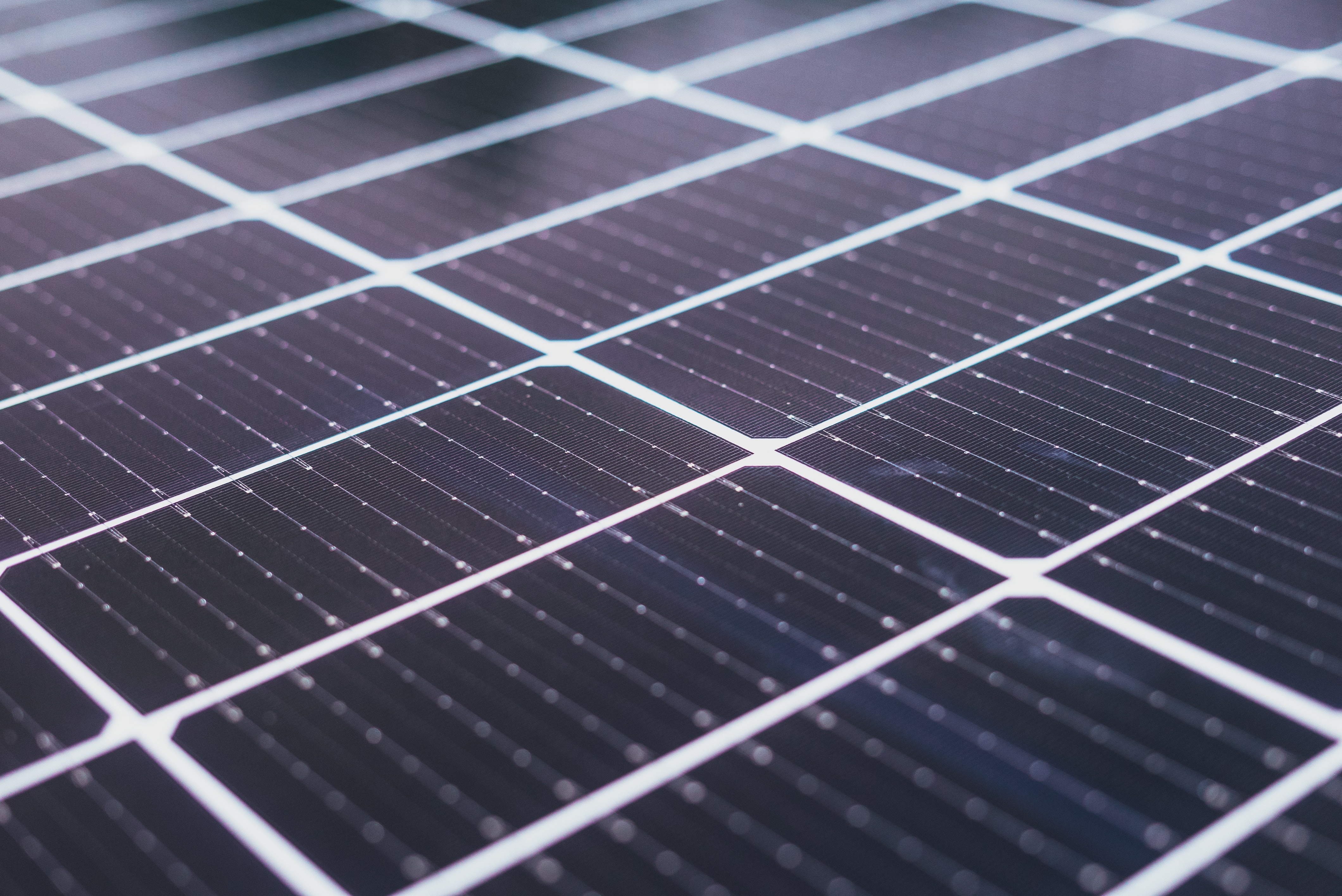

- Product Selection: In our shop's product overviews, VAT-free items are indicated by a green banner labeled "0% Tax Possible" on the product image.

- Add Products to the Cart: Select the desired products and add them to your cart.

- Eligibility Confirmation: By clicking a box during checkout, you must confirm that you belong to the group of persons eligible under §12 para. 3 no. 1 UStG.

- Cart Recalculation: After your confirmation, the cart will automatically update, and the VAT-free items will be listed with 0% tax. Your updated total amount will then be displayed.

Important Notice: If you unjustly benefited from the VAT exemption and it's later determined that you weren't eligible, the regular VAT of 19% will be applied. The difference will be invoiced to you and is due immediately.

For any questions or clarifications, we are always happy to assist. Just contact us!